My story of a startup, small cash-flowing businesses, and how I recently acquired 6% of a public company

Most Buffett nerds have heard the phrase “Buy a dollar for fifty cents”. It’s the ethos of value investing encapsulated in one simple tagline.

It probably doesn’t need too much explaining, but just in case, the phrase is essentially saying to find companies that are “worth” $X but are only trading at ½ of $X. The idea is that if you find that needle in a haystack, and you buy it cheap enough, then the value (and price appreciation) will eventually take care of itself. It’s a big margin of safety thing.

Markets are mostly efficient, but not always efficient. Sometimes just no one is looking.

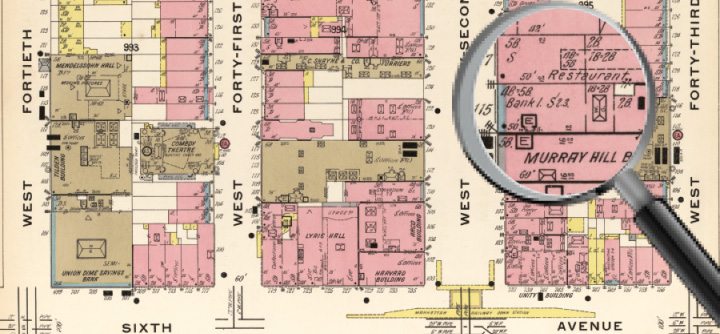

A perfect example from Buffett himself happened between 1958-1960.

The needle in the haystack was called Sanborn Map Company. Sanborn was a fairly boring company that made extremely detailed versions of maps in most large cities. A Sanborn map of a mid-sized city could weigh 50 pounds, and cover stuff like underground water mains, roof composition, fire hydrant locations, etc. It was mostly used for insurance companies.

Sanborn had been a nicely profitable company for decades, reliably bringing in an average $500k/yr in profits. But, by the late 1950’s the business was declining due to some changing industry practices, and it was only bringing in ~ $100k/yr in profits. The stock price had obviously languished.

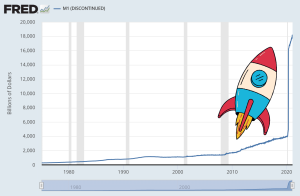

It was at this time that Buffett started buying… heavily. But why would he start buying a dying company? The reason had nothing to do with Sanborns actual map company, and everything to do with an almost unnoticed investment portfolio that Sanborn had built up over the years. Way back in the 1930s, when Sanborn was still cash-rich, the company itself had built up a roughly $2.5 million investment portfolio, made up of ~ 40 companies and some bonds.

Fast forward to 1958, and the investment portfolio was now worth $7.5 million, BUT it was only being recorded in the financials as being worth the original $2.5 million. Literally, no one knew this, except for Buffett of course. Buffett knew, because he read every financial statement and every annual report of every company he could get his hands on. The company was literally trading for less than the value of its stock portfolio alone, not to mention the value of the existing maps business.

So he quietly started acquiring every single share he could get his hands on. He put an astonishing 35% of his partnership’s capital into this one tiny microstock. Once he essentially had control of the company, he prodded the board to distribute the investment portfolio to the shareholders, who realized a massive gain.

The Buffett partnership ended up clocking in an impressive 50% return on their investment… and, most importantly, did so while taking very little risk. The Sanborn Maps business could have gone to zero and closed up shop, and Buffett would have still walked away with a profit.

Now I know what you’re thinking here. “OK, cute story Travis, but WTF does this have to do with today, and what is this 6% teaser you mentioned that made me click on this stupid email?”.

Well… I’ll stop teasing. Let me tell you about Onfolio. (Stock ticker $ONFO)

Juliet and Richard have mentioned Onfolio Holdings in the investing.io newsletter a couple of times, but not like this.

Onfolio is a fairly simple business. They are in the business of buying small businesses. Not particularly exciting businesses, stuff like WordPress plugins, deal sites, marketing agencies (which I love), small display advertising brands, etc.

They are in essence a little micro-conglomerate, focusing on owning a portfolio of profitable cash-flowing businesses. It’s like Berkshire Hathaway, except with about 300 less zero’s and they only buy online businesses.

Onfolio is tiny. No analyst has ever heard of it. The only reason I even know about it is because the founding team just happens to run inside our little entrepreneur circle, so I’ve followed along.

Yet somehow, back in August, they were able to IPO on the Nasdaq. The fact that a little company composed of mostly lifestyle businesses could IPO is still a little unbelievable, but it happened.

Unfortunately for the stock, Onfolio IPO’d on pretty much the absolute worst day possible in the last decade. They IPO’d on August 25th, the day the market finally fully capitulated and dropped a bazillion percent. Everything was “risk off”, and markets dumped everything, especially new unproven ventures.

But, thankfully for the company, the IPO shares were technically sold the day before to private buyers, not on the open market. They sold the IPO “units” at $5 each, and raised $13.7 million.

(note* technically these “units” are one share and two warrants, but the warrants are way out of the money, so even if the warrants get there and are exercised it’s still a net-positive for Onfolio and shareholders as they now have more cash to deploy at a much higher price than the stock trades now).

The proceeds of the IPO are to be used simply to buy more boring cash-flowing businesses.

So, after fees, Onfolio raised $12.67 million in cash from the IPO.

But today, Onfolio’s market-cap trades between $5.5m – $6.5m.

Let that sink in for a moment.

I don’t need to dig into the specific financials here, as I’m not that smart, we’ll just talk in broad strokes. The total value of Onfolio, right now, is trading for around half of the cash they raised in the IPO 2.5 months ago. This doesn’t even include the value of their existing portfolio businesses owned prior the IPO.

🤔

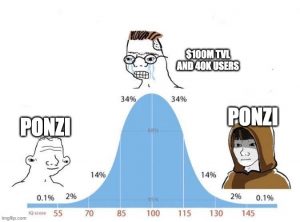

Ok, so once I realized this I started thinking. What the hell am I missing? How the hell can this be?

Turns out companies sometimes do trade for less than cash in the bank. Biotech is a great example, but there is usually a good reason for this.

A biotech company trading for less than cash in the bank is expected to burn through its savings in the quest to develop a novel (and hella-expensive) drug. The market is essentially saying that it doesn’t think the company will get to the finish line, and that it won’t be able to raise new funds, so the company is expected to go broke. This makes plenty of sense to me.

But Onfolio is very different. They aren’t developing new tech, and they don’t have an unproven business model. They are just buying a portfolio of already-profitable small online businesses. Nothing is too uncertain here, nothing is revolutionary.

So, by me buying Onfolio shares at the current price,

I’m essentially getting a 50% discount on every business Onfolio buys.

To rephrase, if Onfolio has $12.6m in cash, and they are going to deploy that cash to buy these little online businesses, then each $1 they deploy only costs me $.50 to buy. It’s ludicrous.

From what I can tell, the “market” has simply thrown the baby out with the bathwater here. I’m just assuming, but I assume most of the sellers (and the short sellers) are just automatically trading all of this, especially since so few even know of the stock. You can see the short interest on Nasdaq, but why would someone short a company that has more cash than it’s worth and is just buying profitable biz’s?

If a trading operation is just trading a large portfolio of tickers, then I can actually see why. At the IPO, the initial financials Onfolio filed are not all that impressive. An automated trader would see weak financials, low liquidity, and a bear market, and automatically sell into it and do well overall. But IMO, none of that is even relevant anymore.

In this one situation, this one needle in a haystack situation, you have to actually know the business to see the value it’s about to have. The $12.6m raised, to be deployed buying biz’s, completely changes all business fundamentals.

Since its IPO, Onfolio has announced three acquisitions (all info taken from SEC filings).

- They purchased Password Protect WP and Prevent Direct Access for $1.25m and maybe $100k in earnouts. In 2021 the biz had $379k in EBITDA, so it was bought at a 3.56x multiple to earnings.

- They acquired Proofread Anywhere for $2.1m upfront, and $2.4m paid out over the next year. In 2021 it has $1.38m in EBITDA (so a 3.26x multiple)

- They acquired SEO Butler (a content/seo agency) for $950k. In 2021 it had $268k in EBITDA. A 3.54x multiple.

(notice that they are only reporting 2021 EBITDA numbers, they need to verify 2022 to be able to report it as they now own the biz)

These are all reasonable acquisitions at reasonable prices based on the market.

But… let’s look at what my “theoretical” costs were for these acquisitions. Since I essentially purchased my Onfolio shares for fifty cents on the dollar, I’m basically getting a 50% discount on anything the company buys:

- So the theoretical cost to me for the WordPress plugins, based on the purchase price of my Onfolio shares, was $675k, or an incredible 1.78x multiple to 2021 earnings.

- So my theoretical cost for the proofreading biz was $2.25m, or a 1.63x yearly multiple.

- My theoretical cost for the content agency was $475k or a 1.77x multiple.

Again I think I need to use the term ludicrous.

So what did I do with this information?

After realizing what was in front of me, I’ve spent the last month and a half quietly acquiring as many shares as I can.

The stock is very thinly traded, so I had to buy in small 5,000 share blocks a few times a day to avoid running up the price and running out of sellers.

As of this writing, I’ve finally accumulated a few hundred thousand shares, representing just under 6% of the company, making me the largest shareholder after the CEO.

Now I’m in the process of filing with the SEC declaring that I’m a +5% shareholder… which I might add is just about the worst fucking thing ever. I think I’d probably rather lose a toe than deal with the Edgar filing system again. HOW CAN IT TAKE 3 FULL HOURS TO UPLOAD A PDF???

But what if? 😱

There are plenty of unknowns about an investment like this. How will they execute? What happens with our economy and markets? How will the individual businesses perform?

I don’t really have any good answers for any of this, but I don’t feel like I need to have any answers. At the end of the day, for me, getting good, profitable, cash-flowing businesses at a 50% discount to value (while having expenses be mostly fixed) makes everything else kinda not important. I have a 50% margin of safety to all kinds of bad stuff happening.

I’m treating this more like an online business fund, and less like a stock. If it were to stop trading on open markets for a couple of years I would be 110% ok with that.

I’ve always been pretty decent at math, but I’ve always believed that the very best investments (and best businesses) don’t actually need a spreadsheet to figure out what makes sense. A simple napkin should do the trick. Treat a stock like an actual business (instead of a ticker), and find a no-brainer.

The cherry on top of it all is that Onfolio actually fits perfectly into my existing investment thesis. I’ve long held the belief that my perfect portfolio is simply an ownership stake in ~ 30+ small businesses. Diversified businesses that spit out cash. This is what I’ve been slowly doing at Smash Ventures, and what I’ve been building up with my portfolio of self-started companies.

Onfolio is a nice extra puzzle piece into that thesis. Although they don’t pay dividends (which can be a good thing), they do the hard work of buying and running all these small businesses for me, while allowing me to just own the stock.

Hope you enjoyed this long ramble!

If you have any thoughts, feel free to reach out.

– Travis

*Update* – Thanks to some quicker-than-expected price surges due to some silly AI mania, I sold out of the majority of my holdings. The discount disappeared, as did my thesis.