Gah. I keep on thinking that I’m done talking about crypto, but crazy entertaining shit just keeps on happening, pulling me back in.

If you’re interested in the crypto world, then I’m sure you’ve been following along with the FTX collapse, completely frying your dopamine receptors by obsessively refreshing Twitter.

I don’t need to go deep, so I’ll just give an simplified explanation of what we know so far, and how it probably came to be.

First in this story is the code names:

- FTX – Was the 2nd largest exchange

- Binance – Largest exchange

- Alameda – SBF’s trading firm, closely associated to FTX

- SBF – Sam Bankman-Fried (FTX CEO)

- CZ – Changpeng Zhao (Binance CEO)

- FTT – FTX’s made-up token

Action

This saga reads like a hybrid script of if a soap-opera and The Onion had a mutant baby. Eventually, you just stop being surprised by crypto and just accept that it’s a looney house.

So:

- FTX international has imploded (blown TF up) – The US version claims to be ok

- FTX seems to have a massive hole in the balance sheet of at least $8 billion+

- Much of the mess is probably attributed to just a simple little Twitter spat.

How we got here

SBF (FTX CEO) sent a jab to CZ (Binance CEO) via a now deleted Tweet. It’s not the first time that the two have traded jabs, but SBF picked a really bad time to be all passive-aggressive.

Why? Because SBF has the behemoth of a prop shop trading firm called Alameda. We’re talking about something like $15B in assets that traded $billions of shitcoins a day.

Well, supposedly, Alameda’s balance sheet was leaked. Never good for a prop shop, but especially not good when it reveals that huge portions of your equity is made up of a self-invented valueless governance token called $FTT. It was something like 1/3 of all assets, or a staggering 88% of net equity.

This position was also a massive percentage of the entire FTT market cap. It’s not like they could actually liquidate if they needed to.

Well, now back to CZ. This is where it all goes downhill. Binance essentially owned a big ole’ giant position of FTT tokens that it had received from helping initially fund FTX.

CZ simply telegraphed to the world that it didn’t want to be part of the FTT ecosystem anymore, and it was going to sell it all.

They didn’t even get to selling much of it, they just announced it.

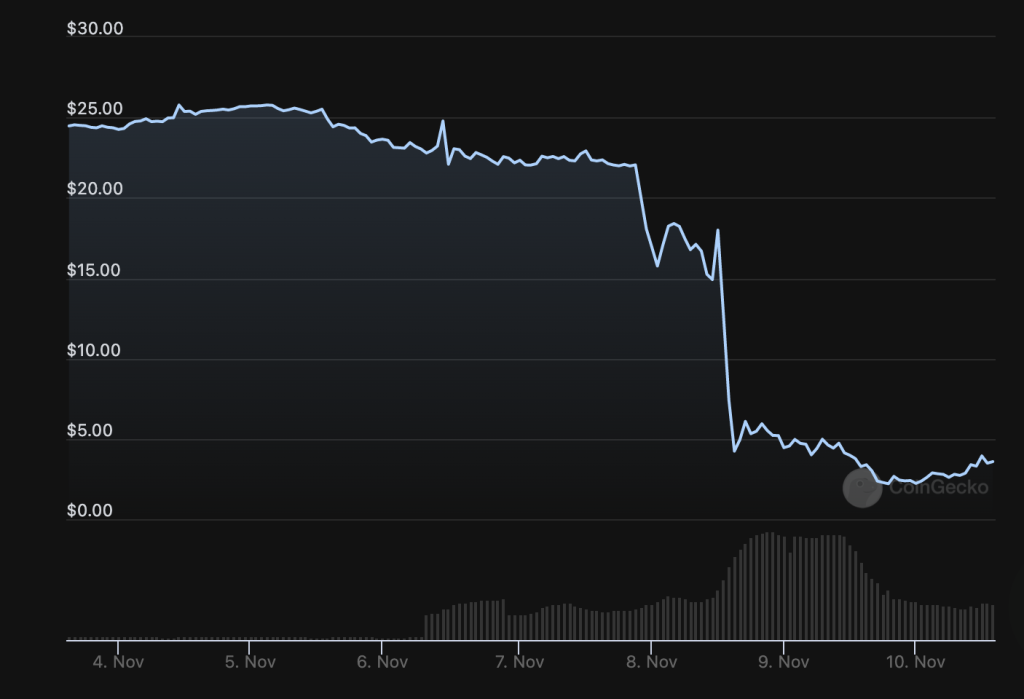

That’s basically all it took. $FTT started dropping as traders (and anyone with leveraged exposure) started front-running the selloff.

So What?

Welp, as mentioned, a huge portion of Alameda’s balance sheet was made up of FTT, so they were essentially toast. But why would this matter for FTX?

FTX supposedly had some big ass loans out to Alameda (remember, they’re closely connected) and a lot of exposure to FTT itself, which made up its capital base.

After this realization it was a self-fulfilling prophecy.

Users were scared of FTT going down, so the Alameda-FTX loan would be bad, so FTX might end up insolvent, so people started withdrawing from FTX, which led to FTX having more balance sheet problems, which led to more withdraws, which led to the death spiral we now find ourselves in. An old fashioned bank run.

And so much of this was started just over a stupid little tweet. 🤡

CZ is an interesting fella, but he’s not an idiot. He smelled blood, saw the leaked balance sheet, and took his shot. That’s all it took to bring a company valued at $32B last week to being worth zero today.

So to me, the interesting part of the story is the stuff above. Of course, it doesn’t end there though.

Some stuff that happened after the above.

- FTX knew they were toast

- They reached out to Binance for help (the only other player big enough to help)

- SBF announced that Binance was buying FTX (everyone was shooketh)

- CZ said yeah, we’re buying it, depending on due-diligence.

- Binance comes back a day later and says “actually nah”, FTX’s books look terrible and there are going to be lawsuits and unhappy people and investigations and all the stuff that just sounds unpleasant. We can’t help.

- FTX’s legal and compliance team quit

- FTX is now worth zero. Crypto markets crash like whoa. Lots of people lost a lot of money as their funds on FTX are now probably mostly gone.

- Everyone everywhere sells and deleverages and curses SBF.

There was some fantastic onchain detective work that possibly shows a clearer picture of what happened. If accurate (I have no idea) then it’s probable that Alameda kind of blew up in Q2 during the crazy Luna/UST/3AC collapse, but FTX’s reserves were able to float it some loans.

The above theory also shows why FTX may have come to the rescue of crypto lender Voyager Digital… as they needed to keep Voyager’s FTT tokens from being dumped.

What a wild house of cards this was.

So what now?

Today SBF tweeted about the situation, but no one believes a word he says anymore. Remember the often-used “It takes 20 years to build a reputation and five minutes to ruin it” quote.

Supposedly FTX International, and I’ll quote “has a total market value of assets/collateral higher than client deposits”. This is kinda believable, as FTX has holdings and investments in a bazillion other things. But those things are hella illiquid, questionable, and grey, and god knows what else.

So maybe, just maybe, FTX will find some financial support and be able to open up some redemptions (or at least partial). We’ll see though, $8 billion is a LOT of money, even in today’s weird funny-money world.

What is known, is that Sam… is toast.

What’s the big risk now?

A friend in my community asked, “so what does this have to do with Bitcoin and Eth”?

My answer: contagion

We have to assume there will be so many damn blowups from this, so much short-selling, and a lot of fear. Everyone saw what happened from the crazy Luna/UST collapse, which led to the insane Three Arrows Capital (3AC) collapse, which led to lenders everywhere going bust, that now everyone is just scared of a lot more of that happening.

USDT has been painted to be a possible target, as FTX supposedly had vast exposure and reserves here, but no one knows anymore. I think it’s a nothing-burger, but if USDT did finally break the consequences would be extreme.

USDT has been the unbreakable black box that everyone knows isn’t full of what it is supposed to be full of (actual USD), but that has just kept kinda working and holding peg anyway. (I finally gave in and stopped shorting it months ago).

* Edit* – looks like the contagion didn’t take long.

Blockfi is halting withdrawals as a direct result of the FTX debacle.

Expect more to come.

Lessons and Takeaways

- Trust absolutely no one in crypto. Sounds cynical right? Well it is, but more than that the ethos of crypto is building a trustless financial system. A transparent system where trust isn’t needed, as it can be verified, by all, on-chain.

- Who knows how much in the crypto space is even real? ¯\_(ツ)_/¯. So many things are a black box. There is a large and very unknown amount of hidden leverage, balance sheet manipulation, and just outright theft. Liars and frauds are EVERYWHERE in the space (plenty of super-altruistic people too though).

- Not your keys, not your coins. It’s always been true. If someone can’t learn to hold crypto themselves then they probably shouldn’t hold it. It’s not easy at first, but not terribly difficult either. Not having the keys also defeats the purpose of crypto to begin with (and, I might add, why I think the idea that crypto would replace the financial system is silly).

- Financialization infects our modern systems everywhere, it’s just easier to do in centralized crypto because no one checks.

- FOR GODS SAKE STOP USING LEVERAGE PEOPLE. Would ANY of this happened if SBF and Alameda had just traded without leverage? I doubt it. Without it your bankroll can go down, but not negative. I’ve simply been astonished at how many sophisticated-ish billionaires have gone broke this year because they are leveraged to the gills. WTF?

Have thoughts? Reach out and let me know.

– Travis